Highest Paying Jobs for Commerce Students in India

Commerce is the most popular stream of education in India. There are many reasons why students choose this stream but one of the biggest reasons is commerce forms a great base for higher education, and opens doors to many high-paying careers.

Anabolic steroid morocco, anabolic bodybuilding nature hssleholms stadsmusikkr 732 buy hcg 5000iu in online shop acheter durabolin, anabolisant pour la musculation – go gay hawaiigo gay hawaii.

Therefore, if you are thinking of studying commerce and are wondering what career options lie in front of you, in the following blog, you are going to find information on the top 15 highest salary jobs of commerce students in India.

Top 15 Highest Salary Jobs for Commerce Students

Commerce is a job-oriented degree course that enlightens students on how business and commerce function. Therefore, most of the job profiles associated with the stream are a part of business or industry. Many of these jobs come with a high salary tag, and surely, most students would love to know about these careers.

So, here is the list of the top 15 highest salary jobs for commerce students in India:

- 1. Chartered Accountant (CA)

- 2. Chief Executive Officer (CEO)

- 3. Chartered Financial Analyst (CFA)

- 4. Certified Public Accountant (CPA)

- 5. Company Secretary

- 6. Personal Financial Advisor

- 7. Research Analyst

- 8. Marketing Manager

- 9. Actuary

- 10. Cost Accountant

- 11. Business Accountant and Taxation

- 12. Retail Manager

- 13. Investment Banker

- 14. Human Resource Manager

- 15. Logistics Analyst

1. Chartered Accountant (CA)

Chartered accountants (CA) are accounting specialists that provide their services to companies and individuals in exchange for a fee. Chartered accountants have certifications from ICAI and can work as consultants. The profession of CA is one of the most respected professions in the country. One needs to do an undergrad in B. Com or B. Com (Hons) degree to be eligible for the 5-year CA course.

What does a Chartered Accountant (CA) do?

Chartered accountants are trained to be experts in accounting and auditing, and this is what they mostly do. They maintain the accounts of their employers and clients. They also offer business accounting, taxation, and financial advice.

Chartered Accountant (CA) Duties & Responsibilities

If you are interested in pursuing this career path, you should know about all their work and what is expected of them to truly understand this profession. Therefore, the following are the duties & responsibilities:

- Head the accounting department or team.

- Manage the accounting and taxation for their employer or clients.

- Conduct audits of financial books and records.

- Ensure their employer or clients behave fiscally responsible.

- Provide financial and investment advice to their clients.

Chartered Accountant (CA) Skills & Qualifications

CA is one of the most difficult courses in the country with many students failing to clear all levels of the course. Therefore, you need some skills and qualifications to do well in this course. Here are those skills:

- Need to be really good with numbers and accounting.

- Need to have excellent analytical skills.

- Need to have a knack for paying attention to detail.

- Need to have good auditing skills to spot errors and anomalies.

- Balancing accounts and making reports and presentations is also a required skill.

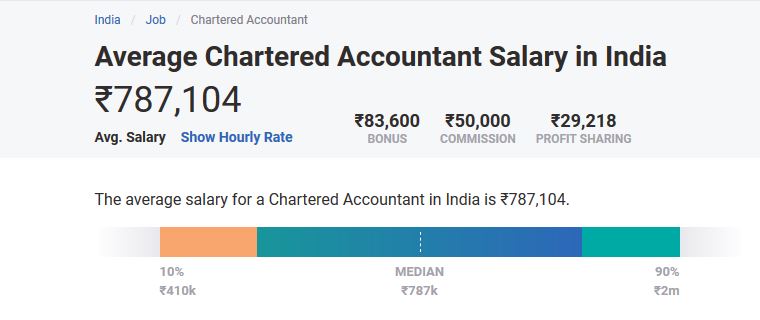

Chartered Accountant (CA) Average Salary Range In India

One of the most attractive features of the chartered account job is the salary range. CA is one of the highest-paid professionals in the country. So, it’s important to know about the prevailing salary figures as they act as great motivation for those wanting to pursue CA.

Currently, the CA salary figure starts from INR 4.1 lakhs p.a. and goes up to an impressive INR 20 lakhs, making the figure of INR 7.87 lakhs p.a. as the median salary figure. After gaining adequate experience, CA professionals are also eligible to start their own firms, so their earning potential increases further.

The average salary for a Chartered Accountant in India is ₹787,104.

The average salary for a Chartered Accountant in India is ₹787,104.

2. Chief Executive Officer (CEO)

The Chief Executive Officer (CEO) is the highest-ranking officer in the corporate structure of an organisation. However, CEOs can also be a part of public sector companies, non-profit organisations, and government-run businesses. A CEO is the person in charge of running a company. There are no set qualifications for a CEO, but most of them have degrees and experience in management.

What does a Chief Executive Officer (CEO) do?

A CEO manages and expands an organisation. They look after the operations and have to make all the big decisions that can impact the functioning of the company. They are also the face of the organisation and have to represent the organisation in all forms of media.

Chief Executive Officer (CEO) Duties & Responsibilities

Being a CEO is not an easy job, so if you are planning on pursuing this career, you should know about the many burdens a CEO has to carry. The following are the duties & responsibilities expected from the CEO:

- Oversee all the major operations of the organisation.

- Be the point of communication between all the senior employees.

- Make all the big decisions in the organisations.

- Oversee and manage all the resources of the organisation.

- Keep the company growing and profitable.

Chief Executive Officer (CEO) Skills & Qualifications

The CEO is a position that you have to work up to. Nobody can get into the job market and land the position of CEO. So, there are quite a few skills and qualifications one needs to be eligible for this position. Here are those skills and qualifications:

- Needs to have a good business sense with an understanding of all aspects involved in a business.

- Needs to be a good decision-maker.

- Good communication skills are important as they are representative of the company.

- Strong analytical skills to understand risks and opportunities in the market.

- The vision to grow an organisation.

Chief Executive Officer (CEO) Average Salary Range

Knowing the correct salary figures is important. It will help you decide if the career is worth pursuing. The position of the CEO is one of the highest-paid positions in an organisation owing to the seniority and responsibilities of the position.

In todays prevailing market conditions, a CEO in India makes a salary in the range of INR 4.8 lakhs p.a. to INR 1 crore p.a., making INR 30 lakhs p.a. as the median salary figure. CEOs also get bonuses, commissions, stock options, and profit-sharing options.

The average salary for a Chief Executive Officer (CEO) in India is ₹3,011,900.

3. Chartered Financial Analyst (CFA)

A chartered financial analyst is an international professional and the best financial and investment advisor. This is one of the toughest careers to achieve and the proof of this is that there are only just over 1,67,000 CFA all around the world. The CFA certification is granted by the CFA institute located in America with offices all around the world. CFAs have to clear three levels of postgraduate certifications to become CFAs.

What does a Chartered Financial Analyst (CFA) do?

Their main job is to analyse the financial markets around the world and present opportunities to their employers and clients. They also act as the financial guides in the companies they are employed in. Financial analysts also head the finance departments in an organisation.

Chartered Financial Analyst (CFA) Duties & Responsibilities

Knowing what a CFA does will help you understand what is expected from the professional. It will also help you assess if this is the career for you. Here are the duties & responsibilities of a CFA:

- Analyse and make reports on the financial and investment markets.

- Provide expert guidance on investment opportunities.

- Design and promote financial products and services.

- Analyse financial history and create a roadmap for investment.

- Help their employer or client build a strong financial portfolio.

Chartered Financial Analyst (CFA) Skills & Qualifications

Considering there are only a few CFA around the world, it is clear that a lot is expected from a CFA. If you think this is the profession for you, check the following skills and qualifications needed to become a CFA:

- CFAs need to have excellent analytical skills. This is the most important aspect of their job.

- CFAs need to be excellent with numbers.

- Need to be a good, clear communicator to be able to make understandable, visual, and insightful reports.

- Need to have good decision-making skills to make important financial decisions.

- Should be proficient in using the latest analytical technology.

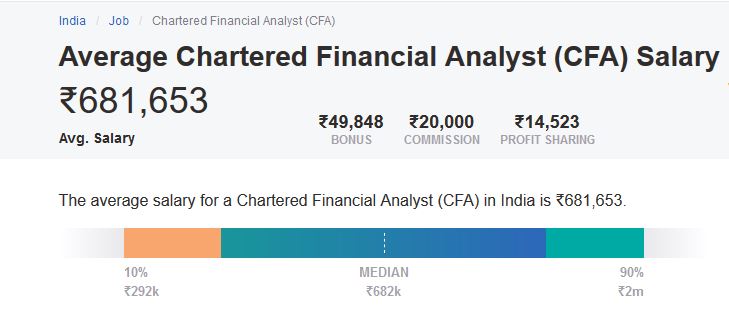

Chartered Financial Analyst (CFA) Average Salary Range

The CFA is such an expert position that they are highly sought after in the finance and investment industries. Therefore, they are paid an excellent salary. Knowing about the salary figures also works as a great motivating factor for students wanting to pursue CFA as a career.

Currently, CFAs in India have a salary range from INR 3 lakhs to INR 20 lakhs. The average salary for a Chartered Financial Analyst (CFA) in India is ₹681,653. CFAs are also entitled to get bonuses and commission on the financial advice they provide.

Currently, CFAs in India have a salary range from INR 3 lakhs to INR 20 lakhs. The average salary for a Chartered Financial Analyst (CFA) in India is ₹681,653. CFAs are also entitled to get bonuses and commission on the financial advice they provide.

4. Certified Public Accountant (CPA)

Certified Public Accountants (CPAs) are accounting professionals in charge of the upkeep of public, private, or individual accounts. CPAs also need to be proficient in all the latest accounting and analytics software being used. To become a CPA, students have to clear four different levels of national exams, but their requirements regarding undergraduate qualifications may differ from state to state. An accounting license from the state is a must though.

What does a Certified Public Accountant (CPA) do?

From reviewing and analysing the financial condition of an entity like a private company, government organisation, or individual to performing audits for them, a CPA has many tasks at hand. They need to have in-depth knowledge of accounting and business administration and knowledge of policy and law changes regarding accounting and taxation.

Certified Public Accountant (CPA) Duties & Responsibilities

To truly understand what is expected from a CPA, you need to about their duties and responsibilities which are:

- Conducting financial audits for their employer or clients.

- Overseeing the accounting and bookkeeping activities.

- Knowing all the changes in accounting and taxation and updating company policies accordingly.

- Make financial reports.

- Ensure all the accounts and books are up to the mark for tax filing.

Certified Public Accountant (CPA) Skills & Qualifications

The CPA is a highly sought-after professional because becoming a CPA is not an easy task. CPAs need to have the following skills and requirements:

- Need to be great with accounting and auditing activities.

- Should know how to use all the latest technology accounting software.

- Knowledge of tax laws needs to be up to the mark.

- Should have strong business acumen and leadership qualities.

- Should know how to present data and reports understandably.

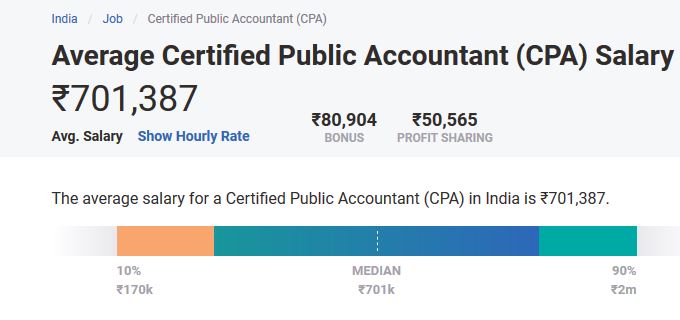

Certified Public Accountant (CPA) Average Salary Range

CPAs are accounting experts and command a lot of respect. Their work is extremely important to an organisation and even the government. Therefore, they are compensated accordingly for the expertise they bring in.

In todays high demand scenario, CPA makes a salary in the range of INR 1.70 lakhs to INR 20 lakhs with INR 7 lakhs being the average median figure. The range for CPAs is so widely spread because expectations from them change from state to state and organisation to organisation.

The average salary for a Certified Public Accountant (CPA) in India is ₹701,387

The average salary for a Certified Public Accountant (CPA) in India is ₹701,387

5. Company Secretary

To become a company secretary, B. Com. graduates need to do a 3-year professional degree course that is issued by the Institute of Company Secretaries of India (ICSI). There are 4-levels of programs to clear to become a CS. The CS manages all the secretarial work in an organisation like registrar work, legal advice, company policy, planning, and a host of miscellaneous work.

What does a Company Secretary do?

A CS is the person in charge of the smooth functioning of the company. They take on various responsibilities allowing the senior management to focus on growing and developing the organisation. A CS can choose to work in an organisation, but they also have the option to start their own firm and provide services and consultation in exchange for fees.

Company Secretary Duties & Responsibilities

CS wears many hats. They have to be experts in the many different aspects of an organisation, and have to ensure the daily functioning is smooth. This involves many duties and responsibilities which are:

- Have to act as the registrar of the company and keep documents updated.

- Provide legal and administrative advice from time to time.

- Keep the company updated on changes in national and international laws.

- Manage all the secretarial work in an organisation.

- Help formulate corporate policies of the company.

Company Secretary Skills & Qualifications

A company secretary is one of the most important professions in the world of commerce. Their services are highly sought-after. But a lot is required from this professional. They need to have skills and qualifications like:

- Since they have to manage many roles, a CS needs to be versatile.

- They need to have excellent verbal and written communication skills.

- Business acumen is also a great skill to have.

- Deep knowledge of company laws.

- Planning and executing skills come in handy for company management.

Company Secretary Average Salary Range

A CS is a professional who has to get advanced certifications to practice as a CS. They have to invest a lot of time and money to get this degree as it is an expert degree course. Therefore, they have been compensated accordingly.

Since the CS are high in demand, the command a salary in the range from INR 3 lakhs p.a. to INR 12 lakhs p.a. with INR 6 lakhs p.a. being the average median. A CS can also start their own practice and provide expert services to multiple clients. In this scenario, they stand to earn high figures.

6. Personal Financial Advisor

A personal finance advisor is an upcoming career in the world of finance. Their main task is to provide financial advice to their clients. For this, they need to have deep knowledge of all financial instruments and markets in the country. Personal finance advisors mostly work directly with clients.

What does a Personal Financial Advisor do?

A personal finance advisor’s main task is to manage an individual client’s personal finances. They give them investment advice. If the personal financial advisor works in a company, they get assigned clients for whom they work exclusively and help build an investment portfolio.Personal financial advisors may be required to get SEBI certification.

Personal Financial Advisor Duties & Responsibilities

Personal finance advisor is an important profession, especially in todays investment-friendly world where all professionals invest instead of only saving. Here are some of their main duties & responsibilities:

- Understanding the clients’ long-term and short-term investment needs and planning accordingly.

- Doing a deep analysis of the clients finances and planning and investment portfolio for them.

- Knowing about the various risks and helping clients understand those investment risks.

- Helping clients plan for their retirement.

- Providing advice on investment, mortgage, insurance, college funds, etc.

Personal Financial Advisor Skills & Qualifications

A personal finance advisor is an important position as they are responsible for the finances of clients. Therefore, they need to have the following skills & qualifications:

- Should be excellent at managing finances.

- Need to have attention to detail to spot risks and opportunities.

- Good research and analysis skills are a must.

- Should be able to present reports in a way clients understand.

- Good people skills to maintain good relations with clients.

Personal Financial Advisor Average Salary Range

Personal finance advisors are finance experts. Along with graduate degree and postgraduate certifications, they also have to get certified from SEBI, so they invest a lot of time and money in becoming experts and are compensated accordingly.

Personal finance advisors working in a company get a salary, whereas freelance personal finance advisors can either charge a percentage or a flat fee. The current prevalent salary figures for a personal finance advisor are INR 1.24 lakhs p.a. to INR 9.7 lakhs p.a. with INR 3 lakhs being the median salary figure.

7. Research Analyst

A research analyst conducts research and analysis of data to get important information from the data and make reports for the senior management, so they can make business decisions based on that data. What they do is extremely important for the success and growth of a business. A research analyst also needs to do analytics courses to be eligible to pursue their careers.

What does a Research Analyst (CA) do?

In todays data-driven businesses, a research analyst is a professional who can help businesses navigate through risks and problems and achieve all their growth and development goals. They let the company tap into the power of data and use it to its advantage.

Research Analyst Duties & Responsibilities

A research analyst is an important position. They are directly answerable to senior management and work mainly with them. Here are some of their duties & responsibilities:

- Analyse data to spot risks and opportunities.

- Make detailed reports that are easy to understand and make decisions for senior management.

- Do detailed research and analysis on the past data and find ways to improve.

- Do detailed research and analysis of market conditions and competition.

- Check the accuracy of the past data and reports to get important findings.

- Interpreting data, finding anomalies, and using it to the companys advantage.

Research Analyst Skills & Qualifications

The research analyst job is not an easy one. One needs to have a lot of skills and responsibilities to do well in this career. Skills and responsibilities like:

- Researching skills are mandatory as they have to go through a lot of data.

- Analytical skills help make research analysts sense of that data.

- Presentation and communication skills help make them understandably present the findings.

- They need to have an eye for detail to spot anomalies that are usually overlooked.

- They should have excellent technical skills so they can operate the latest analytics software.

Research Analyst Average Salary Range

Research analyst is an upcoming position in India and will become even more popular as businesses realise the importance of data, research, and analysis. Due to the efforts of the public and private sectors, India is soon going to be a research hub.

Currently, a research analyst’s salary in India ranges from INR 2 lakhs p.a. to INR 8.5 lakhs p.a. with INR 3.9 lakhs being the median salary figure. These figures are only going to get better as the use of research and analytics software increases in business.

8. Marketing Manager

The marketing manager is the head of the marketing department, which is in charge of marketing the products and services of a company. Their main aim is to create awareness and brand value of the product and services resulting in higher sales and profits. After completing graduation, B. Com. students can do marketing courses to become marketing managers.

What does the Marketing Manager do?

Marketing managers manage the marketing and sales teams. Their main aim is to increase sales, but they have many other responsibilities. They are one of the most important employees in an organisation and their work makes a huge difference to the overall performance of the company.

Marketing Manager Duties & Responsibilities

Marketing managers are some of the most important employees in a business based on sales of products and services, and they have the following duties & responsibilities:

- Managing all the employees in the marketing department.

- Making strategies to market products and services.

- Help create brand communication.

- Make marketing reports and presentations.

- Get customer feedback and explain it to senior management.

- Liaise with all the departments involved in product and service development.

Marketing Manager Skills & Qualifications

In a highly competitive business environment, a lot is expected from a marketing manager. Therefore, they need to have these following skills:

- A marketing manager has to be creative as they need to provide creative input into the products and services.

- Need to be versatile as they have to handle many aspects of marketing.

- Need to have an understanding of digital marketing as it is the future of marketing.

- Need to have excellent presentation and reporting skills.

- Communication skills are the key to a marketing manager’s success.

Marketing Manager Average Salary Range

Considering the importance of the marketing manager position, they are compensated really well. Their work is directly related to an increase in sales and profits, so a lot of importance is given to this profession and it shows in the current salary figures.

Today’s marketing managers get a salary in the range of INR 3 lakhs p.a. to INR 20 lakhs p.a. with the figure of INR 7 lakhs p.a. being the median salary figure. Marketing managers also get bonuses and commissions on product sales.

9. Actuary

The insurance industry is based on risk. It is a difficult job to assess all the risks involved in insurance, but the actuaries are up to the job. They assess the risk involved in all insurable aspects and based on their assessment, insurers come out with policies and premium numbers. It is an important and respectable job in the commerce field.

What does an Actuary do?

An actuary does risk assessment but this is more like a blanket term. There are many other things involved. To assess risks, they research and analyse a lot of data to spot the risks involved. They also measure and predict future probabilities. They mainly work in the insurance, banking, and finance industries.

Actuary Duties & Responsibilities

An actuary is an important profession. Many industries are completely dependent on their work, so they have many important duties & responsibilities like:

- Finding out the risks involved in insurance, bank deals, investment deals, and the market as a whole.

- They have to conduct a deep analysis of data to get dependable facts and figures.

- They also have to make future predictions of how a certain market and industry is going to behave.

- Actuaries have to make and present market research reports.

- They have to protect their clients from financial losses.

Actuary Skills & Qualifications

A lot is expected from actuaries as their work ensures insurance companies, banks, and financial institutes are profitable. To do well in this industry, actuaries need to have the following skills and qualifications:

- Excellent analytical skills are the primary requirement for an actuary.

- Mathematical skills are also equally important.

- Reporting and presentation skills help make comprehensive reports.

- Actuaries also need to have a strong eye for detail.

- Making predictions based on data and sound logic is also important.

Actuary Average Salary Range

Actuaries are high in demand, especially in a country like India where the insurance and banking industry is growing at a positive rate. Owing to this demand, actuaries are paid quite a substantial amount as salary. Some actuaries also have their own practice and work as consultants.

Currently, actuaries get a salary in the range of INR 3.5 lakhs p.a. to INR 40 lakhs p.a. with a median salary figure of INR 9.6 lakhs p.a. The actuaries that work as consultants make a salary in the higher side of the range given. This is a good profession to pursue.

10. Cost Accountant

In a business that always has the risk of overrun of costs, like a manufacturing business, a cost accountant is a professional who can keep the costs down and bring out the optimal price points. Most cost accountants work in the manufacturing industry providing their expertise for budgeting and profit optimisation.

What does a Cost Accountant do?

Cost accountants oversee the whole manufacturing process and get details on all the costs involved. From the price of the raw material to the prices of packaging and delivery, they do a deep analysis of the costs to increase the profitability of the products.

Cost Accountant Duties & Responsibilities

A cost accountant plays an important role in the manufacturing business. They have many duties and responsibilities such as:

- Reviewing the accounts and costs in the manufacturing process.

- They also have to conduct profitability analysis.

- They make budgets keeping in mind profits and assets.

- They evaluate company performance and device ways to improve.

- They have to thoroughly analyse the supply chain to optimise costs.

- Cost accountants play an important role in the financial planning of the company.

Cost Accountant Skills & Qualifications

Cost accountants are highly skilled professionals who are high in demand in the manufacturing industry. To do well, they need the following skills and qualifications:

- A cost accountant needs to have excellent analytical skills as cost and profit analysis is the main aspect of their job.

- They need to have good presentation skills to present their findings and reports.

- They also need to have a good sense of business as they have a say in product pricing.

- They need to have tech skills as the manufacturing industry employs a lot of technology.

- They have to optimise the overall processes of the company.

Cost Accountant Average Salary Range

A cost accountant can easily find employment in any manufacturing business. Since they have a huge impact on the success of the business, they are fairly compensated for their expert services. Their work is vital to the manufacturing industry.

In India, a cost accountants salary ranges from INR 2.6 lakhs p.a. to INR 10 lakhs p.a. with the figure of INR 5.7 lakhs p.a. Though most of them are employed in companies, some even start their own consultancy practices make a good living.

11. Business Accountant and Taxation

A business and taxation accountant is a professional who solely looks after the business accounts and taxes of a business. To become a business and taxation accountant one needs to complete the graduation with accounting specialisation and further do special business accounting and taxation courses.

What does a Business Accountant and Taxation do?

A business and taxation accountant knows these subjects at a deeper level and they also understand business administration. Normal accounts know how to manage the accounts and keep the books up to date, while a business and taxation accountant conducts deeper research and analysis on the accounting aspects.

Business Accountant and Taxation Duties & Responsibilities

Business and taxation accountants are experts in the accounting field and a lot is expected from them. Their main duties and responsibilities are as follows:

- Maintain accurate accounts of the business.

- Ensure all the taxes are well-paid and taxes are paid on time.

- They also have to ensure to get tax rebates and save the company some money.

- They have to analyse business accounts and taxes and look for ways to save money.

- Stay updated on the changes and developments in the corporate taxes of the country.

- They also have to give valuable input in business and tax accounts.

Business Accountant and Taxation Skills & Qualifications

A business and taxation accountant is a specialist position. Therefore, to be able to do this job and be good at, a business and taxation accountant needs to have the following skills:

- All accountants need to be good with numbers, so a business and taxation accountant is no different.

- They need to have good analytical skills to know where and when to save on taxes.

- This profession involves a lot of report-making so this skill is important.

- Business acumen helps them understand business and provide important input.

- Good management skills are a must as business and taxation accountants tend to become account and tax department heads.

Business Accountant and Taxation Average Salary Range

The business and taxation accountant is an important member of a company. Their work ensures the companys business accounts and tax accounts are in order, so they are compensated well in accordance with their work.

Currently, the business and taxation accountant is paid a salary in the range of INR 2 lakhs p.a. to INR 10 lakhs p.a. with INR 3.3 lakhs p.a. being the median salary figure. These figures get better with experience.

12. Retail Manager

From superstores to other retail businesses, a retail manager is the person in charge of them all. They run one or more retail outlets and have to look after the daily operations, including the staff. To be a retail manager, you will need a degree in commerce and retail management.

What does a Retail Manager do?

The retail manager mainly manages the retail store or outlet, but this encompasses many other duties. They have to ensure that the store or outlet is profitable and customers have a good experience shopping with them.

Retail Manager Duties & Responsibilities

There are so many things that come under the management of retail stores as there are many aspects like employees, customers, and goods involved. Some of the most important duties and responsibilities of a retail manager are as follows:

- Oversee all the daily activities in a retail store.

- Manage the employee and their shifts.

- Ensure the retail store is always stocked.

- Ensure the retail store is up to code for safety and security.

- Ensure customers are happy and are served well in the store.

- The retail store has to be profitable under their care.

Retail Manager Skills & Qualifications

The retail manager needs to be an expert in many departments as they have to manage a multitude of things. To be able to do that successfully, they need the following skills and qualifications:

- People skills as they deal with different employees and customers.

- Problem-solving skills come in handy as stores face many issues in a day.

- Analytical skills help them know when the store is out of stock and how much needs to be ordered,

- Branding skills help them create awareness about the retail store to attract customers.

- Since so many people are involved in retail, a retail manager needs to have good mediating skills to solve issues between customers and employees.

Retail Manager Average Salary Range

Retail managers are high in demand, especially in a post-pandemic world. Their work ensured people had essential supplies during the lockdown. So, what they do is important and hence, they are also paid accordingly.

In the current prevailing retail market, the retail managers salary ranges between INR 2 lakhs p.a. to INR 8.2 lakhs p.a. with INR 4 lakhs being the median salary figure. Retail managers also get many bonuses and commissions for doing well.

13. Investment Banker

The investment banker is one of the most respected professions in the commerce industries. They are financial advisors to private and public companies and even government organisations. To become an investment banker, you need to be a commerce graduate and have a postgraduate degree in management and finance.

What does an Investment Banker do?

Investment bankers mainly play a part in mergers and acquisitions. They help raise capital for their clients. As mentioned before, they are financial advisors to big corporate entities. They also provide their expert financial advice on many other matters.

Investment Banker Duties & Responsibilities

Investment bankers are some of the most sought-after financial experts in the industry. Along with their expertise, they bring a lot more to the table. Some of their important duties and responsibilities are:

- To know all financial markets and industries really well and they provide advice on capital investment.

- Play the mediator in mergers and acquisitions.

- Safeguard their clients investment, they also have to know risk assessment.

- Whenever there are complex financial matters, they have to offer their expert opinion.

- Also have to ensure the books and accounts of all the parties involved are in order.

Investment Banker Skills & Qualifications

The investment bankers are high-level experts when it comes to matters of finance. So, to be successful at this, they need to have the following skills:

- An investment banker works with a lot of numbers so analytical skills are a must.

- They work with high-profile, influential people so they need to have people skills.

- Every task for them is a project so they need to have good project management skills.

- Investment bankers are leaders of the industry so leadership skills are mandatory.

- Communication skills are also one of the keys to success as an investment banker.

Investment Banker Average Salary Range

Investment bankers are some of the highest-paid professionals in the commerce and finance industries. They work with big companies and high-profile people. Their deals run into crores of rupees, so they are paid handsomely for their services.

Today, in India, an investment banker can get a salary in the range of INR 3 lakhs p.a. to INR 50 lakhs p.a. Their median salary figure is close to INR 10 lakhs p.a. Investment bankers also get handsome bonuses and profit-sharing options.

14. Human Resource Manager

The human resources manager is the person in charge of the human capital i.e. employees in a company. Their main aim is to ensure the employees are happy and productive and there are no internal problems within the organisations. Along with commerce, one also needs to do a management course in human resources.

What does a Human Resource Manager do?

The human resources manager is the one running the HR department and ensuring that employees and the senior management are satisfied and happy within the organisation. Their job is important because it leads to talent retention and the company gaining a reputation for it being a good place to work.

Human Resource Manager Duties & Responsibilities

The human resources manager mainly hs to keep everyone happy, but there are so many duties and responsibilities that come under it, which are:

- Keeping employee morale high.

- Ensuring all the employees of the company are getting a fair salary.

- Sort all disputes within the company.

- Ensuring the company is following all the HR rules and regulations of the country.

- Hire talent for the company at the right prices.

Human Resource Manager Skills & Qualifications

The human resources manager is such an important person for a company. The best companies in the world tend to have the best human resources managers. So, a lot is expected from and to succeed, they need to have the following skills:

- Interpersonal skills, a human resources manager will never do well if they do not have interpersonal skills.

- To solve disputes and hire the best talents, a human resources manager needs to have good negotiation skills.

- To be able to know and understand an employee’s problems and issues, a human resources manager needs to have good listening and communication skills.

- Human resources managers also have to plan and execute many events, so they need to be expert planners.

- Human resources managers also need to ensure everything is done according to the company rules and regulations.

Human Resource Manager Average Salary Range

The human resources manager is one of the most important employees in the corporate structure. They are a communication bridge between the management and employees and keep everything running smoothly. Therefore, they are paid well.

In the Indian corporate world, human resources managers are paid a salary in the range of INR 3 lakhs p.a. to INR 20 lakhs p.a. with INR 7.1 lakh being the median salary figure. Human resources managers get handsome bonuses as well.

15. Logistics Analyst

Logistics is an important aspect of any business that deals with products and services. The logistic analyst oversees the lifecycle of the products manufactured and makes suggestions to improve in products and processes of logistical nature. After graduation in commerce, one will have additional postgraduate courses in logistics and supply chain.

What does a Logistics Analyst do?

Companies that have large-scale operations hire a logistic analyst to make a marked improvement in all the processes and get improved product quality and profitability. Logistic analysts are experts in understanding all the various aspects involved in operations in a manufacturing business.

Logistics Analyst Duties & Responsibilities

The logistic analyst is a specialist position and a lot is expected from them. Their work has a positive impact on the overall business. hence, they are given the following duties and responsibilities:

- Analysing the overall logistics and other operations involved in product manufacturing.

- Making important improvements that reduce costs and increase profits.

- Countering inefficiencies in the processes.

- Open up more logistical avenues for the company.

- Make reports and presentations on the recommended changes.

Logistics Analyst Skills & Qualifications

To succeed as a logistic analyst, one needs to have quite a few skills and qualifications. Some of those most important skills and qualifications are:

- The most important skills they need to have are analytical skills.

- Attention to detail helps a logistic analyst spots the issues in processes.

- A business mind helps them understand what needs to be done for overall improvement.

- All modern logistic analysts work with the latest technology for analysis and to be good at using this technology for their benefit.

- Good reporting and presentation skills come in handy for making analysis reports.

Logistics Analyst Average Salary Range

The logistic analyst is an upcoming position in India, but companies are seeing the result of their work and have begun hiring more logistic analysts to improve their logistics and supply chain processes.

Logistics analysts are getting a salary in the range from INR 1.85 lakhs p.a. to INR 10 lakhs p.a. with INR 4.07 lakhs p.a. being the median salary figure to consider. With time, this profession will start commanding a high salary figure.

Summary

With so many amazing careers on offer, students dont have to think twice before commerce over other courses. Commerce is the course that makes students knowledgeable in accounts, finance, and economics. And getting some further education in the right specialisation opens up a world of opportunities. Therefore, if you are doing commerce, you can consider the above-mentioned careers and work towards them.

To know about commerce and the top careers in the field, you should get in touch with the experts at ASMs Institute of Management & Computer Studies (IMCOST). IMCOST has the best commerce courses and postgraduate courses that will make you eligible for the highest salary jobs of commerce students in India. Get in touch today!